Introduction

Google started a finance service in 2006 that is currently accessible at http://www.google.com/finance. It offers pretty interesting data and includes the option, for some stocks, to download historical prices through a "Download to spreadsheet" link located precisely at the stock's "Historical prices" page. The article Visualizing Live and Historic Stock Data Using Silverlight analyzes in depth how this can be automated to retrieve historical data automatically. The idea consists of parameterizing a URL of the form http://www.google.com/finance/historical?q={stockCode}&startdate={startDate}&enddate={endDate}&output=csv.

However, this option is not available for many stocks, such as those belonging to some non-American exchanges, or for currencies. Fortunately, there exists an alternative (undocumented) method, the one this article explores, that can be used for almost any security "listed" in Google.

The idea behind it consists of harnessing another source of historical quotes that is accessible through URLs of the type http://www.google.com/finance/getprices?q={code}&x={exchange}&i={interval}&p={period}&f={fields}. With this method, it is possible to download information from any security (as far as I know) provided that Google includes a live chart for it. In fact, I believe that its main aim is to feed the site's interactive charts.

In order to take advantage of this second method, the article introduces a C# .NET 2.0 class library that automates two operations:

- Generating the download URL from some input parameters.

- Transforming the raw data as it is received from Google into a more readable format.

Building the URL and downloading the data

As it has been said, the URL matches the format: http://www.google.com/finance/getprices?q={Code}&x={Exchange}&i={Interval}&p={Period}&f={Fields}. The meaning of the parameters is:

Code. The code of the security. For example, GOOG for Google or EURUSD for the Euro/Dollar currency pair. This parameter is case sensitive and must be capitalized to be recognized.Exchange. The exchange where the security is listed. For example, NASDAQ for GOOG or CURRENCY for EURUSD. The exchange must be in upper case and can be left blank for American exchanges.Interval. Google groups the data into intervals whose length in seconds is defined by this parameter. Its minimum value is 60 seconds.Period. The period of time from which data will be returned. Google always returns the most recent data. Examples of this parameter are 1d (one day), 1w (one week), 1m (one month), or 1y (one year).Fields. The fields to return. This parameter seems to be ignored by Google, as it always returns the date, open, high, low, close, and volume of every interval.

As an example, the URL http://www.google.com/finance/getprices?q=LHA&x=ETR&i=60&p=1d&f=d,c,h,l,o,v means: Download the fields date, close, high, low, open, and volume (f=d,c,h,l,o,v) for the last day (p=1d) grouping the data into 60 second intervals (i=60) for the security LHA (q=LHA) belonging to the exchange "ETR" (x=ETR).

Upon invoking that URL, something similar to this would be downloaded:

EXCHANGE=ETR

MARKET_OPEN_MINUTE=540

MARKET_CLOSE_MINUTE=1050

INTERVAL=60

COLUMNS=DATE,CLOSE,HIGH,LOW,OPEN,VOLUME

DATA=

TIMEZONE_OFFSET=120

a1306998060,14.84,14.95,14.83,14.93,54359

2,14.84,14.84,14.84,14.84,97

3,14.865,14.865,14.84,14.84,5584

4,14.875,14.875,14.875,14.875,1230

5,14.865,14.885,14.85,14.88,14962

6,14.845,14.86,14.84,14.86,7596

7,14.855,14.855,14.84,14.845,20912

8,14.845,14.85,14.845,14.85,9833

9,14.85,14.85,14.85,14.85,2358

...

As it can be seen, the information returned is composed of two parts:

- A header. It ends with the

TIMEZONE_OFFSET entry. The most interesting fields are:

COLUMNS: Defines the order in which data line fields appear.INTERVAL: The number of seconds that every line of data represents.

- Data. This part is made of several lines with the close/high/low/open/volume values for a period of length 'interval' for the line's date. The date is represented in two ways:

- Absolute. Format: 'a' + number of seconds elapsed since January 1, 1970 (the beginning of the UNIX era). In the example, only the first line of data uses it ('a1306713600').

- Relative. Format: number of intervals elapsed since the last "absolute date".

The class library

The class library contains two classes:

DownloadURIBuilder. Its mission is to create the URL to download the data. It exposes these constructor and methods:

public DownloadURIBuilder(string exchange, string tickerName);

public string getGetPricesUri(int interval, string period) {

public string getGetPricesUriToDownloadAllData(DateTime lastDate);

public string getGetPricesUriForRecentData(DateTime startDate, DateTime endDate);

public string getGetPricesUriForLastQuote();

DataProcessor. Interprets the data and translates it into something more readable. This class contains two public methods:

public String processStreamMadeOfOneMinuteBarsToExtractMostRecentOHLCVForCurrentDay(

Stream stream, out string errorMessage) {

public String processStreamMadeOfOneDayLinesToExtractHistoricalData(Stream str,

out string errorMessage)

As an example, the procedure to download all the historical data for the Euro/U.S. dollar currency pair would be this:

- Create a

DownloadUriBuilder object setting the exchange parameter to CURRENCY and the tickerName parameter to EURUSD. Both parameters must be capitalized (that is, Google would not recognize CuRRency or EurUSD). The class library does not set this parameter automatically to upper case. This makes it more flexible, as it will be able to support possible future exchanges or tickers with lower case characters. - Invoke the class method

getGetPricesUriToDownloadAllData() and use, for example, the returned URL to download the data using the WebClient class of the framework. - Create an object of type

DataProcessor and call the method processStreamMadeOfOneDayLinesToExtractHistoricalData(Stream str, out string errorMessage). The stream can be obtained using the OpenRead() method of the WebClient class. If everything goes right, errorMessage is null or empty and you can use the returned data string. Else, you can use this output parameter to display what has gone wrong.

The demo tool

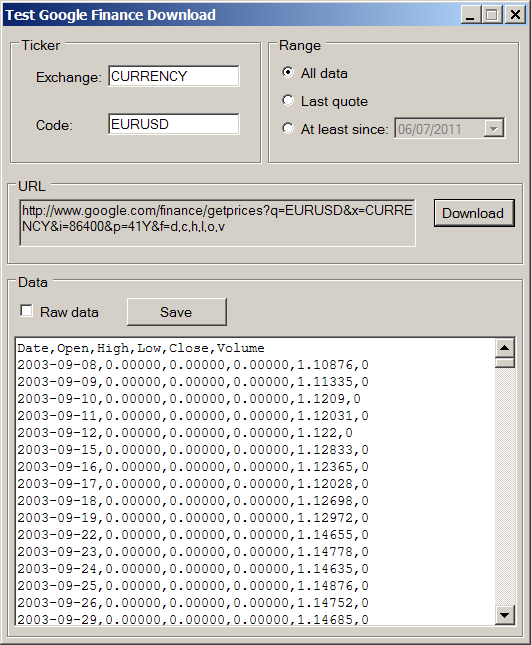

The demo tool is pretty simple and straightforward. It is a Windows application with a single form divided into three blocks:

- A first block allows the user to choose the URL building parameters: the exchange, the ticker, and the interval to download.

- The second block displays the current URL.

- The third and last block displays the data downloaded after pressing the "Download" button. It includes the possibility of displaying the data processed through a call to one of the methods exposed by

DataProcessor or as it is returned from Google by clicking the "Raw Data" check box. There is also an option to save the results by clicking the "Save" button.

Conclusion

This article describes a simple way to download financial data by using one of the undocumented features of Google Finance. I hope that you will find it useful for your purposes.

History